Chapter 11: Investing

Learn the basics of investing.

Investing

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

— Robert Kiyosaki

Author of Rich Dad, Poor Dad

A person can put money in several types of investment opportunities including stocks, bonds, real estate, or a business venture. Some investors are more aggressive than others and therefore put themselves in a position to make more money than a less aggressive investor. A general rule to remember is that the riskier an investment opportunity, the more potential reward is presented. However, with risky investments there is the possibility of losing everything. To minimize risks some investors put money in a number of different investment opportunities that spread out the risk across risky and less risky investments.

Warren Buffet also known as the “Wizard of Omaha,” is one of America’s most successful investors. Buffet began his business career in 1951 and worked in several investment jobs. He eventually started his own investment company and by 1962 was a millionaire. Buffet continued to invest in American corporations like Coca Cola, ABC Capital Cities and the like, and by 1990 his company, Berkshire Hathaway, was worth over a billion dollars. He originally paid $14.86 per share for Berkshire shares (which he acquired) and today, the share price is worth over $222,000 (at the time of this writing), making him America’s second richest man at $63 billion. He still lives in Omaha, Nebraska in a house he purchased for $31,500 in 1957.

What are Stocks?

“Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part-ownership of a business.”

— Peter Lynch

Businessman and stock investor who managed

Fidelity investments and turned $8 million into

$14 billion in a span of 13 years.

A stock is a unit of ownership in a company. Individuals can own stocks as well as large investors like mutual funds or investment companies. Most individuals and large investors make money off of stocks in three ways:

Increase in Share Price

The first way is to buy shares at one price and sell them at a high price. For example, if you bought 100 shares of Nike stock at $50.00 per share it would have cost you $5,000. If the stock increases to $75.00 per share the stock would be worth $7,500. If you sell your stock you would have made a total of $25 per share or $2,500.

Dividend

Another way individuals make money off of stocks is from dividends. Let’s say Nike decides to pay a $1.00 per share dividend every year. That means that you will receive a dividend of $100 at the end of the year for those 100 shares.

Early Investor In Common Stock

A third and not-so-common way to make an enormous amount of money in stocks is to be an early investor in a company. However, this opportunity is typically only available for institutional investors, high net worth individuals, and “family and friends.”

Stock ownership is the most risky because not all stock prices go up. Some stock prices go down because the business is not successful. Also, not all companies pay a dividend. If you are interested in stocks as an investment, consult an investment professional, e.g. a financial planner or stock broker.

Warren Buffet also known as the “Wizard of Omaha,” is one of America’s most successful investors. Buffet began his business career in 1951 and worked in several investment jobs. He eventually started his own investment company and by 1962 was a millionaire. Buffet continued to invest in American corporations like Coca Cola, ABC Capital Cities and the like, and by 1990 his company, Berkshire Hathaway, was worth over a billion dollars. He originally paid $14.86 per share for Berkshire shares (which he acquired) and today, the share price is worth over $222,000 (at the time of this writing), making him America’s second richest man at $63 billion. He still lives in Omaha, Nebraska in a house he purchased for $31,500 in 1957.

What are Bonds?

In 2009 the citizens of Allen, Texas voted to approve a $119 million bond to build a 18,000 seat high school football stadium and other facilities. The bonds will be paid off with various tax dollars.

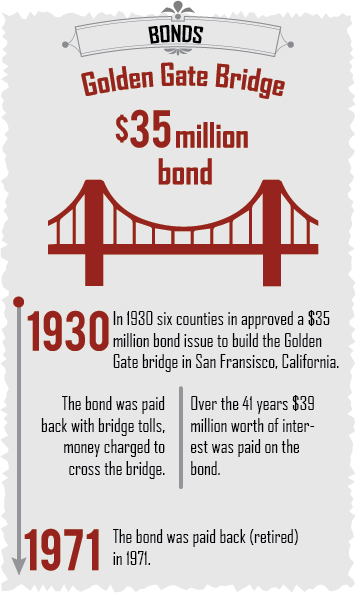

There are several types of bonds (government, municipal, and corporate). However, the basic idea behind a bond is that a company or government will borrow money and pay it back with a low-interest rate over a period of time.

In 1930, people in six counties voted to issue a bond for $35,000,000 to build the Golden Gate bridge in San Fransisco, CA, a bridge that would eventually serve hundreds of thousands of cars per day. The bond would be paid back using the toll revenue over a term of 40 years at a 5% interest rate. In the investment world bonds are considered low risk meaning it’s highly likely that you will increase your investment.

In the case of Allen, Texas, the city believes it will pay back its bonds because its population has grown from 2,000 in 1970 to 84,000 in 2010. The average household income per year is $95,000. With a growing population and more people paying property, sales, and other taxes, the city believes paying back the bond is highly likely.

Real Estate As An Investment

“Real estate investing is get rich slow, not get rich quick,”

— Scott McGillivray

Real estate investor

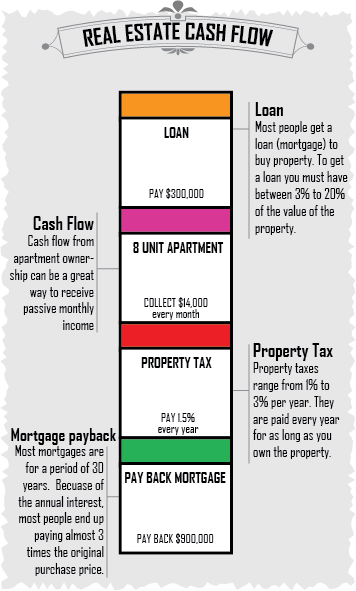

Real estate investments are considered safe over the long term and include buying a house, apartment buildings, commercial buildings, and land. Perhaps the most common type of real estate investment is a house. Many individuals buy a house and keep it for a long period of time. In most cases, if you buy in the right area, the property value of a house appreciates (go higher) over time.

Apartment ownership

Many individuals purchase apartment buildings as a way of earning extra monthly income. Apartments range anywhere from two units to 20 or more. The purpose of this type of investment is to rent out each apartment unit for a profit. In most cases individuals can make a profit of a few hundred dollars to several thousand dollars a month. Apartment ownership is also an excellent way to earn money during your retirement years.

In 1992, Yamen Sanders, a former USC basketball standout began his career as a professional basketball player. Having never played in the NBA, Sanders instead played over 15 years in various leagues in Europe and South America. During that time Sanders, a 6’8” power forward, invested in several income-producing apartment buildings. Today Sanders owns a formidable portfolio of apartment buildings that provides him with income to support his family. His diligence and discipline as a professional basketball player has paid off handsomely. Sanders will never have to work a traditional job in his life and he should be financially secure well into retirement.

What Is A Venture Capitalist?

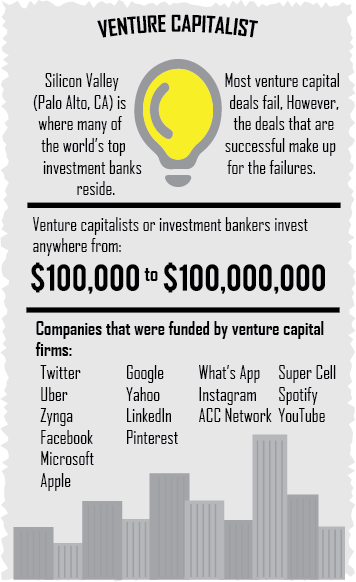

Tom Perkins is one of the founders of Kleiner, Perkins, Caufield & Byers, one of the most successful venture capital firms of all time. He is worth an estimated $8 billion.

A venture capitalist firm is a company that specifically invests in new or burgeoning businesses. Venture capitalists take money from high net worth individuals and invest it in new ideas through what’s called a fund. For example, let’s say that you want to start a venture capital fund. You find 50 high net worth individuals to give you $200,000. Your fund is now worth $10,000,000 and you are now a fund manager! For simplicity, let’s say you invest $1,000,000 in 10 newly formed companies. The idea behind this kind of investment strategy is that a third will fail, a third will break even, and a third will hit big and make up for the losses of the other investments. Venture capital investment is extremely risky but when successful, can be enormously rewarding.

In July of 2014 NBA star Carmelo Anthony started a ventured capital firm called M7 Tech Partners. They currently have investments in 10 companies ranging from children’s media and kitchenware to commuting and pet health. NBA great Steve Nash also has a venture capital company called Consigliere Capital.

What Is An Angel Investor?

In 2013, angel investors invested more than $23 billion in 67,000 deals, 23% of which was in software companies.

An angel investor is a wealthy person who invests his or her personal money and expertise into a business in exchange for a small percentage in a company. Angel investments usually range from $20,000 to hundreds of thousands of dollars. Angel investment is extremely risky because in most cases they are investing in an idea and not a proven product. However, if a product or service becomes successful, an angel investment can be extremely rewarding, both economically and personally.

Ron Conway is one of the most successful angel investors in recent times with early investments in Google, Twitter, Square, and PayPal. Peter Thiel, one of the founders of PayPal, is also a well known angel investor with investments in Facebook, LinkedIn, and Yelp. Thiel invested $500,000 in Facebook for 10% of the company. That initial investment is now worth billions. He also has a famous initiative where he has given 20 kids under the age of 20 $100,000 to pursue innovative projects in science and technology.

The Athlete's Handbook: Life Skills Coaching Tips for the Game of Life | Copyright 2018 David Hollaway | All rights reserved | Press Kit | Academy | Contact