What are Taxes?

“In this world nothing can be said to be certain, except death and taxes.”

— Benjamin Franklin

Governments receive money in three ways—they print it, they borrow it, or they tax its citizens (you).

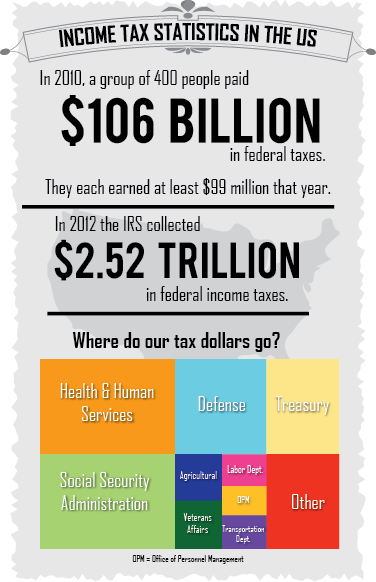

Taxes are what citizens of a country pay to the government. In turn, the government takes those taxes and uses them to build roads, bridges, provide food stamp programs, housing, healthcare, defense (Army, Navy, Marines, etc.) and other services. In the United States the Internal Revenue Service (IRS) is responsible for collecting taxes.

Types of Taxes

The 3,000 athletes that make up the NFL, NBA, and MLB pay about $3 billion in federal taxes.

— David Carter

Executive Director USC Sports Business

Institute

In America there are a number of different taxes that citizens must pay. Although there are several more, below are the most common taxes:

- Federal income taxes - This is money paid to the federal government on money that is earned through salary and wages. Currently, Americans will pay between 10% or 39.5% in federal income taxes. Some individuals do not pay taxes at all. Federal income tax rates vary from individual to individual and are determined by a number of factors including how much money an individual makes, whether they are married or single, or whether they have children, just to name a few.

- State income taxes - Citizens are also expected to pay state taxes on income earned in a given state. Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have state income taxes.

- Property taxes - Individuals who own property pay property taxes at a percentage of the purchase price of the property. They range from 1% to 3% a year. For example, if you purchased a home and it cost $300,000 and had a property tax of 1.5% you would pay $4,500 every year for as long as you own the property.

- Sales tax - Sales taxes are paid to state and local governments (cities) and are usually items like clothes, electronics, sodas, etc. Most products have a sales tax. Sales taxes vary from state to state and range from 0% to as high as 10%. Alaska, Montana, Oregon, New Hampshire, and Delaware do not have a state sales tax.

- Corporate tax – Just like individuals most corporations are subject to what’s called a corporate tax. The tax ranges from 15% to 35%. If you own a corporation it is looked upon as separate entity from yourself. For example, when it’s time to pay taxes, you will pay your individual taxes as well as the taxes for your corporation.

- Payroll tax – Payroll taxes are what employers and employees pay. There are two types of payroll taxes; 1) Employee Withholdings – This is a portion of the employee’s earnings that is withheld by the employer. It is thought of as an advanced payment of income tax. 2) The second type of payroll tax requires the employer to pay a tax for employing a worker.

- Capital gains tax – This is a tax that individuals pay on the sale of a stock, bond, or property. For example, if you bought a house for $250,000 and sold it 10 years later for $450,000, you would pay a capital gains tax on the $200,000 profit ($450,000 - $250,000).

-

Inheritance or Estate Tax

– When a person passes away their estate is subject to an estate or inheritance tax. An estate is considered the sum of a person’s possessions. This may include a house, bank accounts, and property (cars, clothes, jewelry). This tax is also known as the death tax. In 2010 New York Yankees owner, George Steinbrenner, who died with an estimated estate worth $1.1 billion, avoided paying the death tax. His family was lucky because had he died in 2009 instead of 2010 his family would have owed the government $500 million. If he had died in 2011 his estate would have owed $600 million. Luckily for the Steinbrenner family they ended up paying nothing because the federal estate tax had expired that year (2010).

Filing Taxes Every Year

Actor Wesley Snipes was sentenced to three years in prison when he was found guilty on three counts of failing to file a federal income tax return. He owed the government $17 million in back taxes and penalties.

Every year all citizens must report the amount of money they made on or before April 15th on a tax return (W2). Although it is not a requirement, most of the time a certified public account (CPA), should complete a tax return.

The two most important tax forms are the:

- 1040 - This is the form that most people will fill out. It contains questions about how much money a person made and whether they have any deductions. Deductions allow you to deduct (subtract) certain things from your income. For example, if you made $100,000 in a year and you have $10,000 in deductions, you would pay taxes on $90,000 ($100,000 - $10,000), not the $100,000. The government allows deductions for various things like auto expenses, charitable giving, health insurance, and more.

- W2 - This is a form that an employer provides an employee at the end of the year. It contains the total amount of wages and salaries an employee earned in a given year. It is used along with the 1040 form as proof of a worker’s wages.

Tax Troubles

After his famed boxing career it was determined that former World Champion boxer Joe Louis owed the IRS over $1,000,000 (in the 1950’s)

There are very few people who get away with not paying taxes. Some do it intentionally, others are financially ignorant or are scammed by trusted advisors. In the eyes of the government none of that matters. If you make $100,000 in a year don’t assume that you can spend the total amount. You will have to pay taxes.

The penalty for not paying income taxes can range from jail and fines to payment of the back taxes with interest. So it’s a good idea to, one, hire a good accountant, and two, get in the habit of paying taxes.

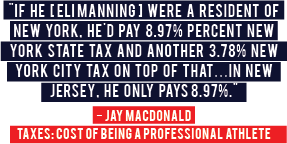

Paying Taxes in Every State

“The tax returns for most people are relatively simple as compared to an athlete’s because they only have to know the rules for one state.”

— Forbes Magazine K. Sean Packard

Athletes and entertainers have to pay taxes in the states that they perform in. Accountants called this the “jock tax.” Tax rates are calculated differently in every state and from sport to sport. For example, basketball and hockey players are taxed on the ratio of games played in a state over the total games played. Football players are taxed on the number of days worked in a state over the total days worked. Although Tennessee doesn’t have a state income tax on wages they do charge athletes a $2,500 per game tax (3 games max). The city of Pittsburgh charges athletes a 3% tax for games played in the city. As a professional athlete taxes can become quite complicated once you consider the various taxes in different states. This is another reason to hire a competent accountant and/or tax advisor.

Paying Taxes Overseas

“The United States is the only nation . . . . that taxes citizens wherever they reside, including an estimated 7 million expatriates.”

— Boston Globe

April 30, 2013

American athletes who play overseas must pay US taxes on their income as well as in the country in which they play. Taxes vary from country to country. In 2011 golfer Phil Mickleson won $2.1 million in golf tournaments in the United Kingdom (UK). Because of UK tax laws and US federal and state taxes, tax experts projected that he brought home less than $900,000 after taxes.

The same rules apply to foreign athletes. They have to pay taxes in the US and in their country. In the 2014, it was revealed that Kenyan runners take home about 15% of their earned income. Approximately 30 to 35% goes to the country they compete in, 15% to their agent, 10% to the manager, and 30% to the Kenyan government. Geesh!!

The Athlete's Handbook: Life Skills Coaching Tips for the Game of Life | Copyright 2018 David Hollaway | All rights reserved | Press Kit | Academy | Contact